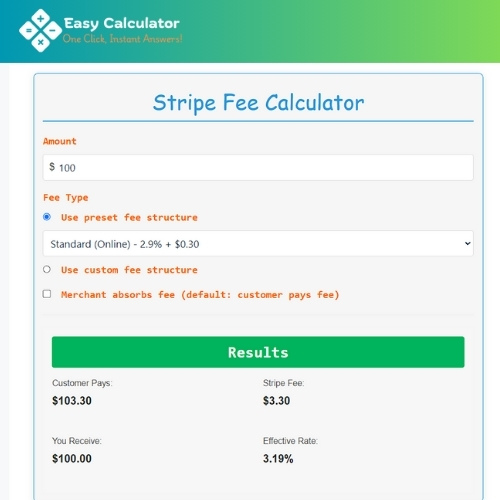

We recently launched a free stripe fee calculator for businesses, freelancers, and e-commerce merchants. Now, with just a few clicks on the fee calculator, receiving an instant breakdown of the transaction fees has never been easier. In addition, it helps you estimate the net amount you will receive. Stripe is one of the most popular payment processing platforms, allowing businesses to accept online payments conveniently. This article will explain how Stripe fees work, how to calculate them manually, how to use a free Stripe fee calculator, and how a Stripe Fee Calculator can help you manage your finances more effectively.

Stripe Fee Calculator

Results

Customer Pays:

$103.20

Stripe Fee:

$3.20

You Receive:

$100.00

Effective Rate:

3.10%

What is a Stripe Fee Calculator?

A Stripe Fee Calculator is an online tool that helps you quickly calculate the fees deducted by Stripe for each transaction. Instead of manually working through complex formulas, this tool instantly shows you how much money you will receive after processing fees.

Key Benefits of a Stripe Fee Calculator:

➤ Instantly calculates Stripe fees based on transaction amount

➤ Supports different currencies and international payments

➤ Helps businesses set the correct product pricing

➤ Provides accurate financial forecasting

Understanding Stripe’s Payment Processing Fees

Stripe’s fee structure is designed to be transparent, but it can still be challenging to calculate exactly how much you’ll pay per transaction. The platform typically charges a standard fee for most transactions, with some variations depending on your business type, transaction volume, and payment method.

Standard Pricing Model

For most businesses in the United States, Stripe charges:

➤ 2.9% + $0.30 per successful credit card transaction

➤ 2.7% + $0.30 per successful in-person card transaction

➤ Additional fees may apply for international transactions or unique payment methods

Breaking Down the Fee Structure

Let’s dive deeper into what these fees mean for your business:

➤ The percentage (2.9%) represents a portion of the total transaction amount

➤ The flat fee ($0.30) is charged per transaction, regardless of the sale amount

➤ This means both small and large transactions incur the same base fee

How to Use a Stripe Fee Calculator

Using the Stripe Fee Calculator is simple. Here’s a step-by-step guide based on the input fields:

- Enter the Amount: Input the total payment amount you expect.

- Choose the Fee Type:

➤ Use preset fee structures (Standard 2.9% + $0.30)

➤ Use a custom fee structure if different rates apply

- Select Who Covers the Fee:

➤ Default: Customer pays the fee (added to the total cost)

➤ Merchant absorbs the fee (deducted from your earnings)

- Click on ‘Results’: The calculator will display:

➤ Total amount customer pays

➤ Stripe processing fee

➤ Your final payout after deductions

➤ Effective processing rate

➤ This quick process allows you to adjust your pricing accordingly.

The Importance of a Stripe Fee Calculator

The use of a Stripe Fee Calculator provides business owners with a more precise revenue outlook and enables them to improve product pricing and overall business financial strategies. Here is how it enhances business operations:

➜ Improved Financial Planning

Precisely estimating the amount left after Stripe deductions aids in effective budgetary planning and management, so there aren’t any surprises.

➜ Improved Sales Strategy

If you are an e-commerce merchant, having a Stripe fee calculator will guarantee a better understanding of what costs need to be covered compared to what profit needs to be maintained.

➜ Saves Time & Increases Accuracy

An automated Stripe Fee Calculator produces results within seconds, eliminating manual steps when calculating fees per every transaction.

➜ Facilitated International Transaction Cost Management

Business operators who accept payments from various parts of the world will find that a Stripe Fee Calculator is essential in estimating international payment fees and currency exchange costs.

How Stripe Fees Work

Stripe charges fees based on different factors such as transaction type, country, and additional services. The standard fee structure includes:

- Domestic Transactions

For businesses in the United States, Stripe charges a standard fee of:

✓ 2.9% + $0.30 per transaction (for online card payments)

✓ 2.7% + $0.00 per transaction (for in-person card payments using Stripe Terminal)

- International Transactions

✓ For payments involving international cards, Stripe charges an additional 1% fee. If currency conversion is required, another 1% fee applies.

- ACH & Bank Transfer Fees

✓ ACH direct debit: 0.8% per transaction, capped at $5.00

✓ Wire transfers: $8.00 per transaction

- Instant Payout Fees

✓ 1% of the payout amount with a minimum fee of $0.50

Manual Calculation vs. Stripe Fee Calculator

| Feature | Manual Calculation | Stripe Fee Calculator |

|---|---|---|

| Accuracy | Prone to errors | 100% accurate |

| Speed | Time-consuming | Instant results |

| Currency Support | Requires manual conversion | Automatic currency conversion |

| Complexity | Requires formulas | Simple input and result |

| Ideal For | Small transactions | Businesses, freelancers, and e-commerce |

Tips to Reduce Stripe Fees

While Stripe’s fees are competitive, you can minimize costs with these strategies:

- Encourage ACH or Bank Transfers (Lower Fees)

Offer discounts for customers who pay via bank transfer (0.8% vs. 2.9%). - Negotiate Custom Pricing

If you process $100K+ monthly, Stripe may offer discounted rates. - Avoid Currency Conversion Fees

Use multi-currency accounts to accept payments in the customer’s currency. - Prevent Chargebacks

Use explicit billing descriptors and instant refunds to reduce disputes. - Compare with Competitors

Sometimes, PayPal or Square may be cheaper for certain transactions.

Conclusion

Understanding Stripe’s transaction fees is essential for businesses and freelancers who rely on the platform for payments. A stripe fee calculator eliminates manual calculations, saving time and ensuring accurate financial forecasting. Whether you run an e-commerce store, a subscription service, or a freelance business, this tool helps you plan better and optimize your earnings.

Use a stripe fee calculator today and take control of your transaction costs!

Explore this related calculator:

Fast & Accurate Stud Calculator for Walls, Framing & Drywall

Free Asphalt Calculator: Calculate Tons, Cubic Yards & Cost

SCHD Dividend Calculator: Estimate Your Passive Income

Instant Reverse Sales Tax Calculator – Get Pre-Tax Cost

Bike Calorie Calculator: Estimate Cycling Calories Burned

Instant Tree Removal Cost Calculator: Get Accurate Estimates

Fast & Accurate Stud Calculator for Walls, Framing & Drywall

FAQ

How much is the Stripe fee for $100?

Stripe charges 2.9% + $0.30 per transaction, so the fee for $100 is $3.20.

How much is Stripe fee per charge?

The standard Stripe fee is 2.9% + $0.30 per transaction for online payments in the U.S. Fees may vary by region and payment method.

Is PayPal or Stripe cheaper?

Stripe typically has lower fees for high-volume businesses, while PayPal may be more cost-effective for small transactions due to different pricing structures.

Stripe fee calculator international?

Stripe’s international fees vary by country, usually around 3.9% + a fixed fee. Use an international Stripe fee calculator to get accurate costs.

Stripe fee calculator euro?

For transactions in euros, Stripe charges around 1.5% for European cards and 2.9% for non-European cards, plus a fixed fee.

Stripe fee calculator app?

No need Stripe fee calculator, use our free Stripe fee calculator online and get instant results.

Passing the Stripe fee on to customers?

Businesses can adjust pricing to include Stripe fees or use a surcharge model where customers cover transaction costs.

Stripe fees for international payments?

International payments typically incur a 3.9% fee plus an additional currency conversion fee.

Reverse Stripe fee calculator?

A reverse Stripe fee calculator helps determine the amount a customer should pay to ensure you receive the exact intended amount after fees.